BUSINESS OWNERS & ENTREPRENEURS

$50K+ TO $250K AT 0% APR

FUNDING FOR YOUR BUSINESS

With our special Funding Formula, running your business becomes effortless, because you have cash flow that works FOR you, not against you.

Make sure your sound is turned on (Please wait for video to fully load)

What is the Funding Formula?

The Funding Formula Is a Simple 3 Step Plan To Get Maximum 0% APR Funding

Step 1: Optimize your personal credit profile, so that banks are BEGGING for your business.

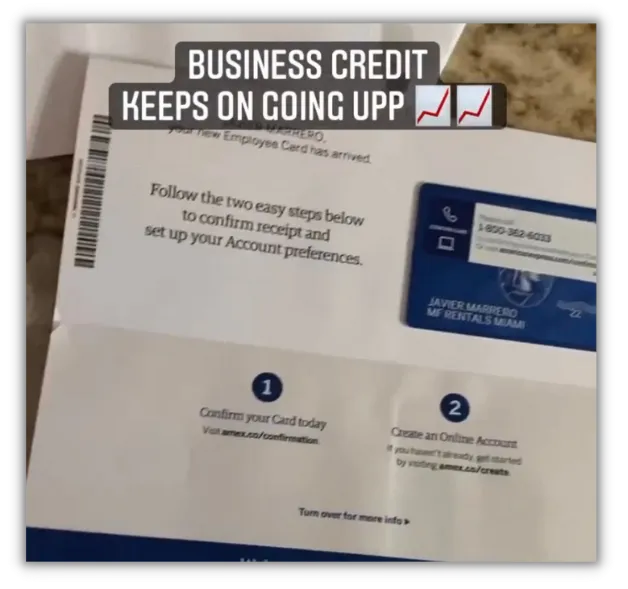

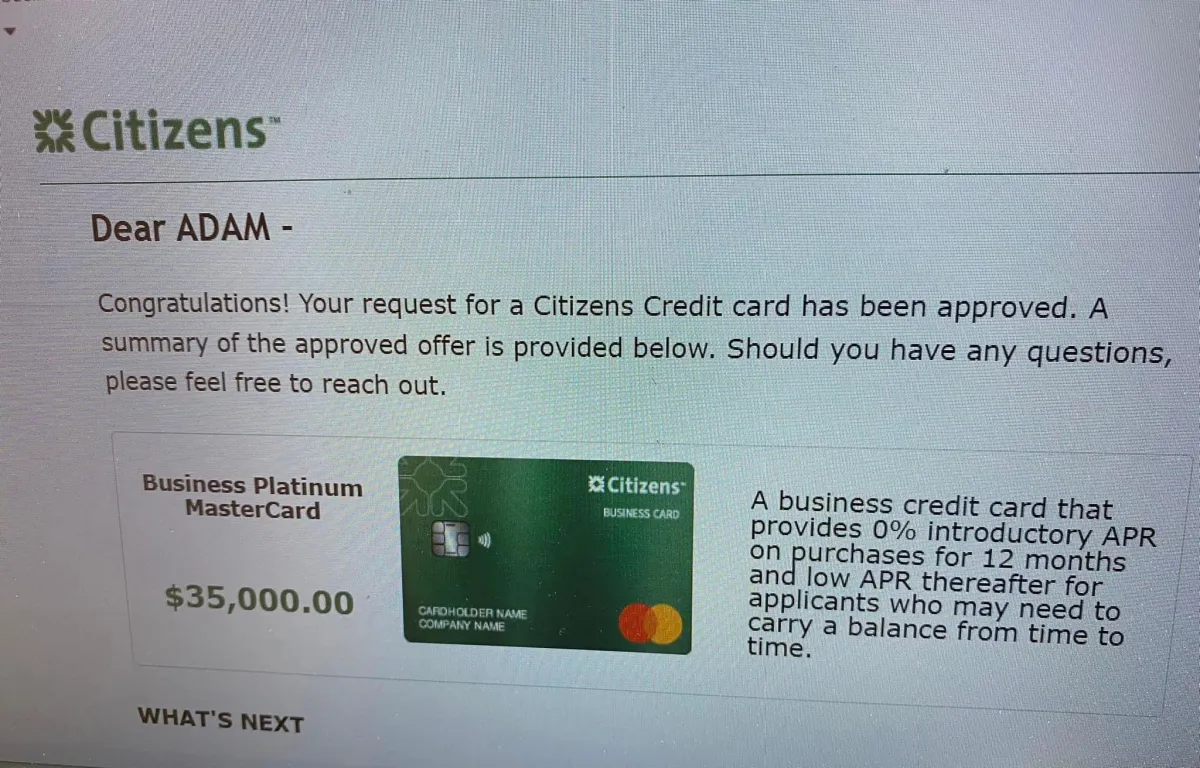

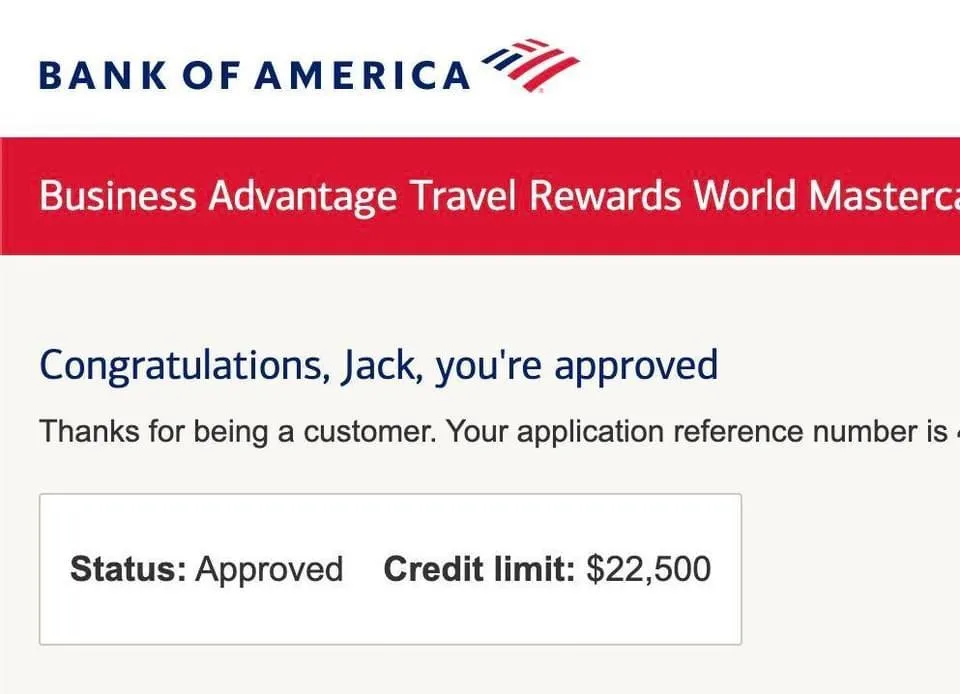

Step 2: Build a relationship with the banks that you want to get funding from. This includes Grade A banks like Chase, Bank of America, American Express, as well as smaller and regional banks like Truist, PNC, and Credit Unions.

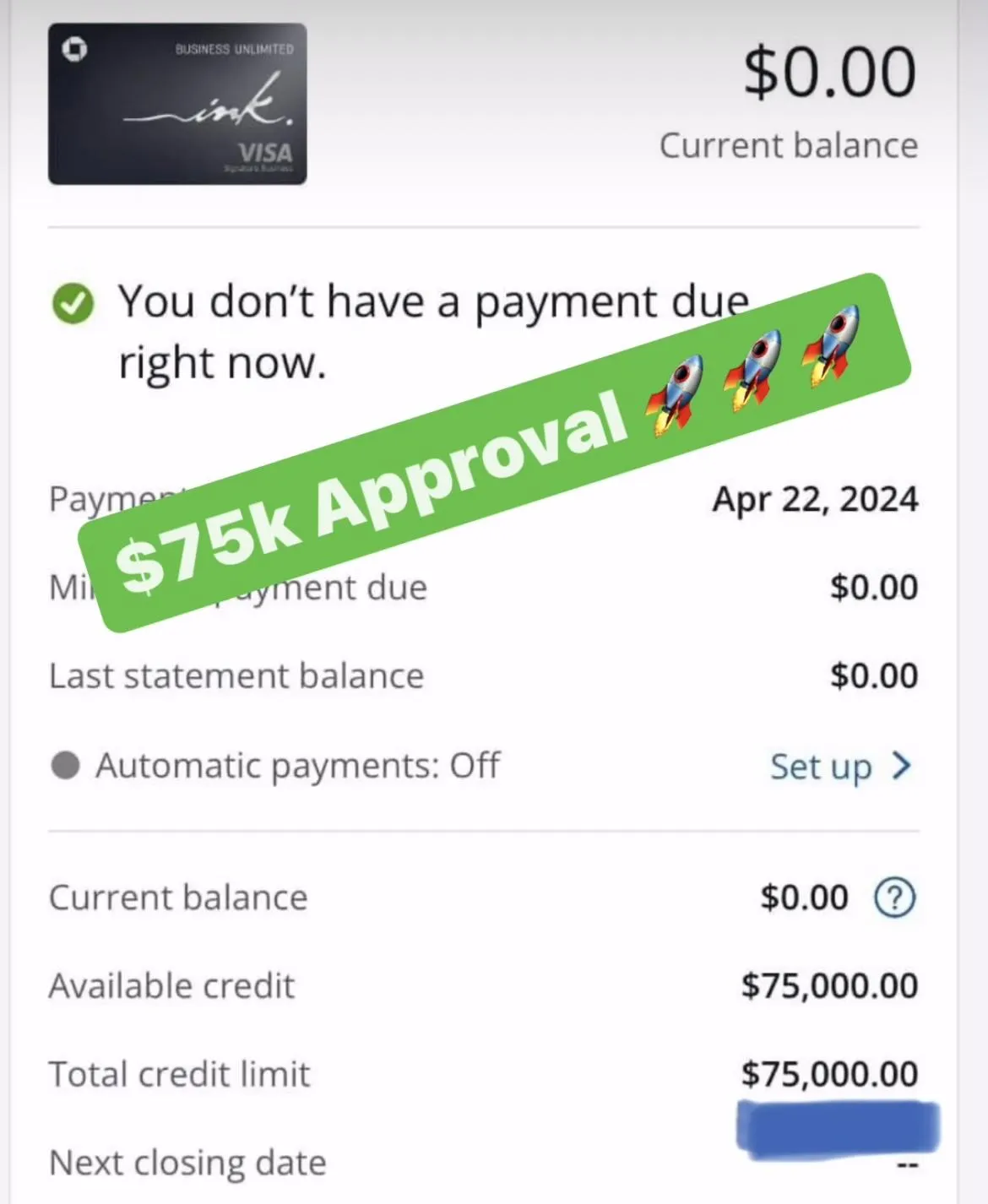

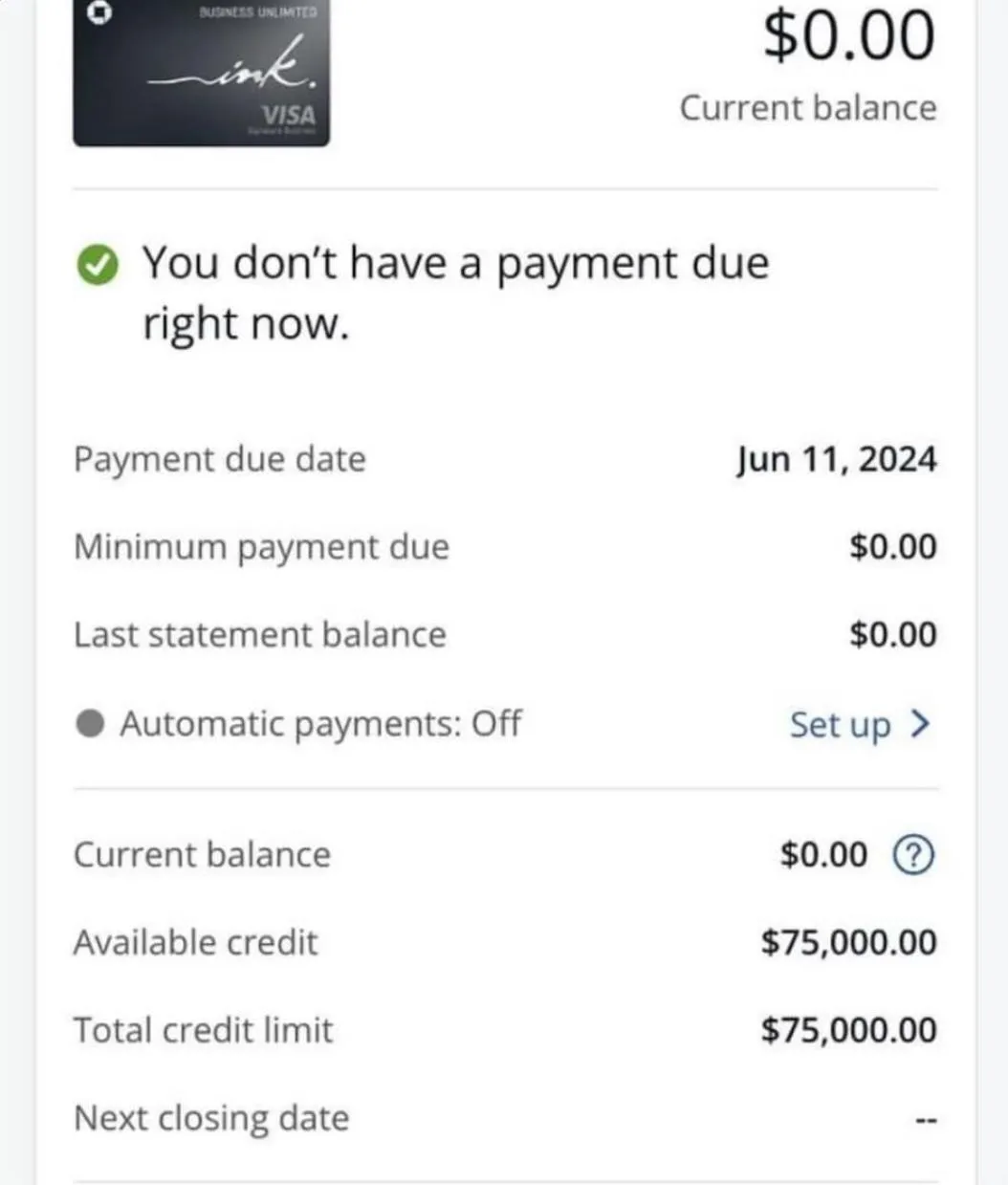

Step 3: Apply for the right 0% APR Business Credit Cards using the correct date points and utilizing our Banking Relationship Managers to achieve maximum funding.

Does The Funding Formula

Actually Work?

Nick Souders

Second Act Support Services

Niche: Real Estate

Result: $85,000 in 32 days

Second Act Support Services: Nick was able to secure $85k with 0% APR in 32 days with a 2 year old personal credit profile.

Nick started Second Act to proved housing to people that just got out of prison and don't have anywhere else to go. He experienced this himself and wanted to help other people in need. He only got his first credit card less than 2 years ago and was struggling to build his personal credit. He didn't even know that business credit was an option and was running his day-to-day operations with just cash, limiting his business growth.

The Process:

When we first started working with Nick, we guided him step-by-step on how to boost his personal credit profile to maximize his approval odds. We added authorized users to boost his history, added accounts to help with his credit mix, and finally, successfully applied for business credit cards.

The Result:

We were able to fund Nick with $85,000 of 0% APR business credit, even with a very young personal credit profile. Now he is ready to finally separate his business from his personal finances and have cash flow to invest in new properties.

Igor Yankiver

Kiver EDU

Niche: online coaching

Result: $105,000 in 3 weeks

KIVER EDU: Igor Went From $0 to $105k in fundings in just 3 weeks

When Igor came to us, he was covering all his business expenses with his own cash and sometimes even using his personal savings to run ads for his business. Igor knew that if he continued this way, he would never be able to scale to the numbers he wanted.

The Process:

When Igor started, he said, "All I want is some funds to cover the upfront costs without using my own money." He knew that he could book appointments and recoup the money to pay it back, but he wanted to stop putting his own cash on the line.

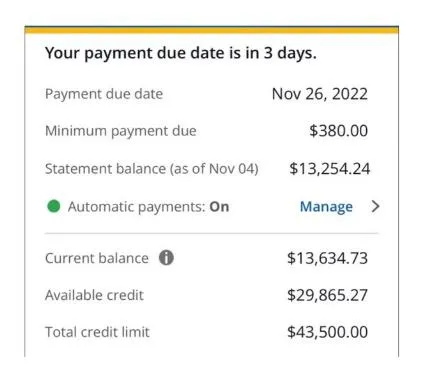

We analyzed his credit profile and built a detailed plan for him. As a result, he got approved for a total of $105,000 on two different credit cards in just 3 weeks.

The Result:

Igor was able to put a credit card toward his recurring payments, allowing him to start collecting reward points, cash back, and giving him time to sell his course while keeping his cash in the bank.

Etten Real Estate

Steven Etten

Niche: Real Estate Investing

Results: From investing with cash to OPM

Etten Real Estate: Steven Went From Investing with Cash to OPM

When Steven came to us, he was a real estate agent and investor with only one property. He was looking to grow his Real Estate portfolio and get involved in the deals he was already closing for his clients. The problem is he didn't have enough cash.

The Process:

We helped him apply the simple 3 step Funding Formula. Cleaning up his personal credit profile only took a few weeks. Being added as an authorized user, lowering his credit utilization, and opening high limit accounts. This boosted his personal credit by 50 points. We helped him establish relationships with Chase, Bank of America, and American Express. Then he was ready to apply with our relationship managers. In a few weeks he was able to secure over $100,000 of 0% funding to expand his portfolio.

The Result:

Steven went from struggling to finance his deals to leveraging other people's money and 0% lines of credit to fund and build his real estate portfolio.

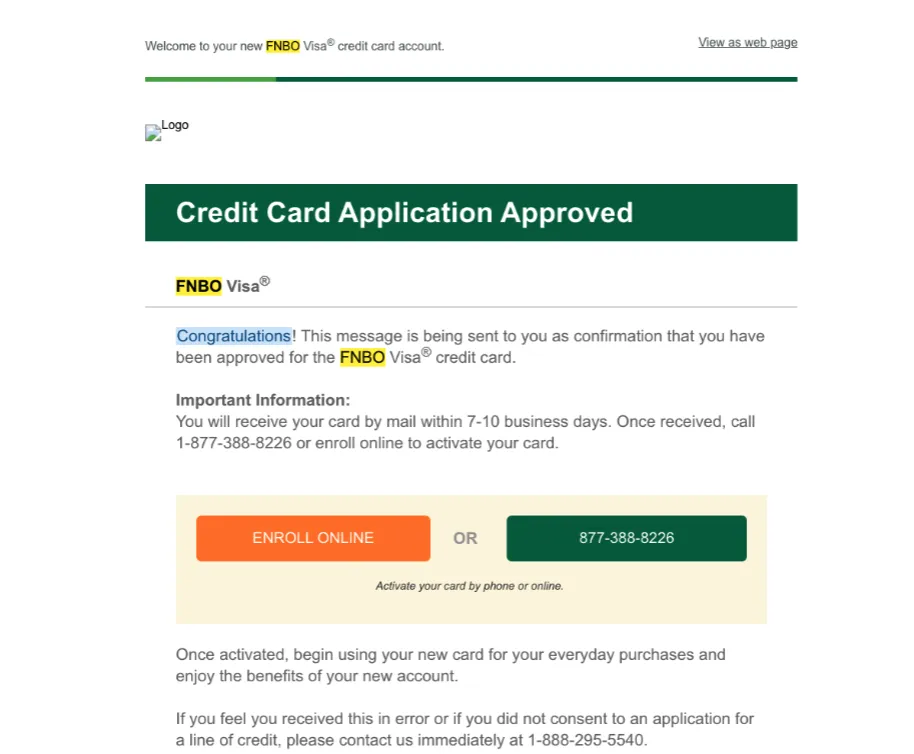

PEOPLE APPROVALS, YOU CAN BE NEXT!